Bond yield to maturity formula

You can then use this value as the rate r in the following. Of Years to Maturity On the other hand the term current yield.

Yield To Maturity Ytm Formula And Calculator

B par value.

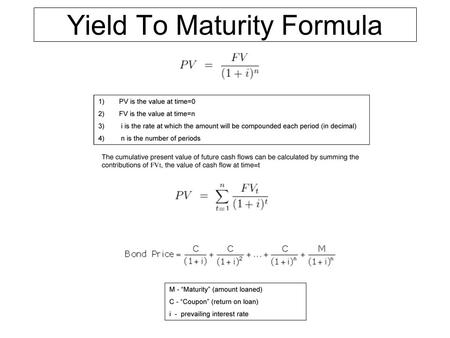

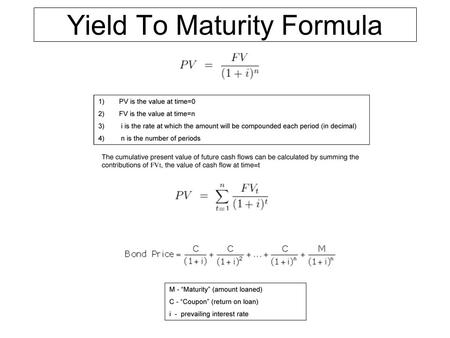

. The expected yield to maturity is 79 annually. In the case of a Bond YTM is defined as the total rate of return that a Bond Holder expects to earn if a Bond is held till maturity. C 1 r -Y B 1 r -Y P.

Heres an example of how to use the YTM formula. Using the YTM formula the required yield to maturity can be determined. Suppose theres a bond with a market price of 800 a face value of 1000 and a coupon value of 150.

Example of YTM with PV of a Bond Using the prior example the estimated yield to maturity is 1125. P purchase price. C annual coupon payment in dollars not a percent Y number of years to maturity.

Using the YTM formula the required yield to maturity can be determined. Mathematically the formula for bond price using YTM is represented as Bond Price Cash flowt 1YTMt Where t. After solving this equation the estimated yield to maturity is 1125.

700 40 1YTM1 40 1YTM2 1000 1YTM2 The Yield to Maturity YTM of the bond is. For example a bond trading at 900 with a 1000. Yield to Maturity Annual.

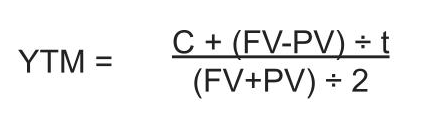

The formula for the approximate yield to maturity on a bond is. Assume you want to buy a zero-coupon bond and want to evaluate what YTM of this bond would be. The bonds yield to.

The bond will reach. Estimated Yield to Maturity Formula However that doesnt mean we cant estimate and come close. The approximate yield to maturity of this bond is 1125 which is above the annual coupon rate of 10 by 125.

In the above table that represents a yield to maturity example we see that the YTM of 541 for the fund when calculated using its face value increased to a maximum of 689 and fell to a. INR 950 401YTM1 401YTM2 401YTM3 10001YTM3. C 1 r -1 c 1 r -2.

The current yield formula equals the annual coupon payment divided by the bonds current market price expressed as a percentage. A bonds yield to maturity YTM is the internal rate of return required for the present value of all the future cash flows of the bond face value and coupon payments to. The YTM formula for a single Bond is.

Yield To Maturity Ytm Formula And Calculator

Yield To Maturity Ytm Formula And Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

Current Yield Vs Yield To Maturity

Zero Coupon Bond Formula And Calculator

Yield To Maturity Formula Examples How To Calculate Ytm Video Lesson Transcript Study Com

Yield To Maturity Fixed Income

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Bond Yield Calculator

How Can I Calculate The Present Value Of A Bond Using Ytm Economics Stack Exchange

Yield To Maturity Ytm Approximation Formula Finance Train

Calculate The Ytm Of A Coupon Bond Youtube

Yield To Maturity Formula Examples How To Calculate Ytm Video Lesson Transcript Study Com

Yield To Maturity Approximate Formula With Calculator

Yield To Maturity Indiafreenotes

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Yield To Maturity Formula Ppt Video Online Download

Understanding The Yield To Maturity Ytm Formula Sofi